Market Thoughts

The markets manage to continue higher!

$SPY

It was a huge week for the bulls, as the indices closed strong across the board. This week marks both the end of the month and the quarter, so it should be exciting to see how things progress into Q3 of 2023!

This week, the SPY closed at $443.28 (+2.33%), finding some resistance at the $442 call wall. The bullish MACD cross on the monthly time frame is worth keeping an eye on, as it suggests this move could just be getting started.

Looking at the weekly $SPY chart -

Looking for a daily close above $443.90 to continue with a bullish thesis

The next level to watch is $448.50

This week, the QQQ closed at $369.42 (+1.90%), making it the weakest performer of the three indices. Some resistance was found at the $368 call wall, but much like the SPY, the bullish MACD cross on the monthly chart does suggest this move could just be getting started.

QQQ is currently range bound between $355 and $371. The tech sector was up for the week and for the month, but the QQQ is not participating quite as much. We will see if the QQQ can break and hold above the $372 level.

$IWM

Small caps continue to lag so the $IWM closing above $186.50, the next stop up for $IWM is $189.46. If $IWM can work through resistance at the $191-$192 level, the upside on $IWM becomes promising.

Market Sectors

A top-down trading strategy means we are always looking at the sectors as part of the analysis before triggering an entry into a trade.

Critical Economic News for the Week

July 3, 2023: PMI Manufacturing Data

July 5, 2023: FOMC Meeting Minutes and Fed Speaker John Williams

July 6, 2023: ADP Employment Numbers and Jobless Claims

Get this week’s economic calendar for free →>https://us.econoday.com/byweek.asp?cust=us

Swing Trading Education Center

Understanding Terminology

The starting point for learning how to swing trade in the stock market requires knowledge of terms that are used quite frequently. The following list of terms is definitely important for traders to understand.

Stock: A share or ownership stake in a company. Investors buy and sell stocks in the stock market.

Swing Trading: A trading strategy that aims to capture short-term price movements in stocks or other financial instruments. Traders hold positions for a few days to a few weeks.

Bull Market: A market characterized by rising stock prices over an extended period. It indicates an overall positive sentiment and investor optimism.

Bear Market: A market characterized by falling stock prices over an extended period. It indicates an overall negative sentiment and investor pessimism.

Volatility: The degree of variation in the price of a stock or the overall market. Higher volatility implies larger price swings, which can present both opportunities and risks for swing traders.

Technical Analysis: The practice of analyzing historical price and volume data to predict future price movements. It involves studying charts, patterns, and indicators to make trading decisions.

Fundamental Analysis: The evaluation of a company's financial health, performance, and prospects to determine its intrinsic value. Fundamental analysis considers factors like earnings, revenue, balance, and industry trends. Fundamental analysis is not used when to swing trading.

Support and Resistance: Levels at which the price of a stock tends to find buying support (support) or selling pressure (resistance). These levels are determined by historical price patterns and can guide swing traders in making entry and exit decisions.

Stop-Loss Order: An order placed to automatically sell a stock if its price reaches a specified level. It helps limit potential losses by ensuring that trades are exited if the market moves against the trader's position.

Profit Target: A predetermined price level at which a swing trader aims to sell a stock to lock in profits. It is set based on the trader's desired risk-to-reward ratio and the stock's price movement potential.

Trade Idea

Each week I’ll include one possible trade set-up based on research done throughout the week. These trade ideas should not be construed as financial advice. Do your own research, as nobody can care more about your money than you!

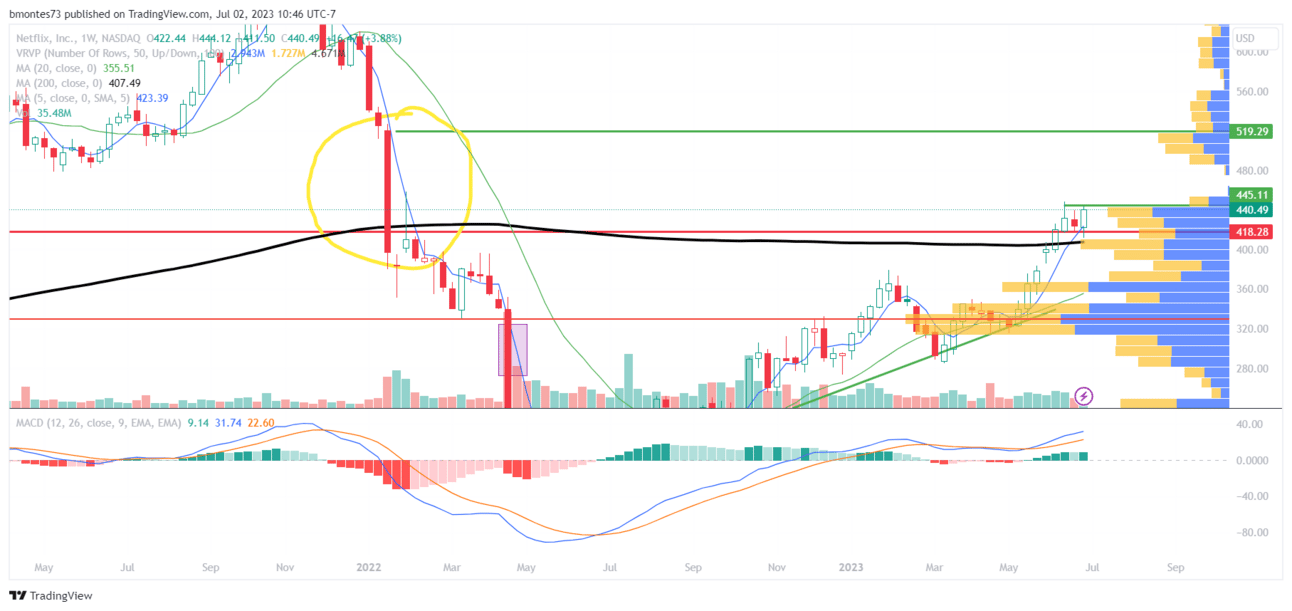

$NFLX

On the daily chart, $NFLX had a nice bounce from $418 and 4 days of consolidation created a support/resistance flip, establishing $418 as a level of support.

At the close of June 30, 2023, $NFLX closed at $440.29 with a high of $447.39. I’d be looking for a daily close above $445.11 to set the next leg up.

On the weekly chart, the candle close of June 30, 2023 is a bullish engulfing candle from the day previous, which is a strong bullish sign for $NFLX. With a closing confirmation above $445.11, $NFLX may look to fill the gap from January 18, 2023, moving $NFLX back into the $500 range.

Reward to Risk Ratio

If this trade setup happens, the $445 could be used as a technical stop loss (especially if $NFLX breaks $445 and consolidates along that line, forming a better level of support. Using $445 as a trade invalidation is the only way to keep the stop loss at a max of 4%.

Keep in mind that $NFLX has earnings on July 23rd, and one of my trading rules is to never trade over earnings. If this trade triggers, there could be a run-up into earnings and an opportunity to catch a nice move.

Set your alerts on this stock and let’s see what happens!

Remember to develop your trading plan and manage your risk on every trade. Stay green and we’ll see you for next week’s Traders Playbook Newsletter

Disciplined Traders Research

Looking for potential charts with market analysis, reward-to-risk scenarios, and trade invalidations, check out the DTA Stock Market Research subscription.

Help Us Grow

Our mission is to impact 1,000,000 new traders positively. If this playbook would help someone you know make learn how to swing trade the stock market please forward it to them.

And if someone forwarded this edition to you, please don't leave without hitting that Subscribe button now.