Market Thoughts

$SPY

This week the $SPY closed at $439.97 (+0.79%), making it another week below the ascending channel but inside the previous weekly candle. The 20-week MA is currently serving as support and with the Stochastic RSI nearing oversold conditions, the index could be setting up for a reversal higher in the week to come. There is quite a bit of short-term unusual options positioning favoring puts so the Bulls and the Bears will be battling out the market direction.

$QQQ

This week the $QQQ closed at $364.02 (+1.65%) below the rising wedge and not confirming the head and shoulders pattern that is forming. The Stochastic RSI shows oversold conditions so there is potential for a higher move in the coming weeks. We will have to see if the H&S pattern confirms or if we get a move-up.

Market Sectors

A top-down trading strategy means we are always looking at the sectors as part of the analysis before triggering an entry into a trade. We use FinViz as our free tool for reviewing market futures and analyzing sector performance and news.

Critical Economic News for the Week

August 29, 2023: Consumer confidence at 9:30 AM EST and JOLTS at 10:00 AM EST

August 30, 2023: GDP at 8:30 AM EST

Get this week’s economic calendar for free →>https://us.econoday.com/byweek.asp?cust=us

Swing Trading Education Center

How to Short ETFs such as the Q’s without trading options.

Options are touted as a great way to make quick cash. Unfortunately, for new traders, using options usually comes with more risk than reward. Learning to swing trade successfully should be done by starting with mastering the skills required to trade equities with a deep understanding of technical analysis.

If you do not trade options, how do you take advantage of bear markets and significant pullbacks in bull markets?

There are trading instruments that allow you to short ETFs. However, traders should note that such products are suitable only for short-term traders as these are rebalanced on a daily basis.

If you are interested in shorting the QQQs, there are three instruments you can use. The trading instruments are the SQQQ, QID, and PSQ. All three of these instruments rise higher when the QQQs are going down. These instruments are meant for short-term trading only. They are not meant for any long-term buy & hold strategy.

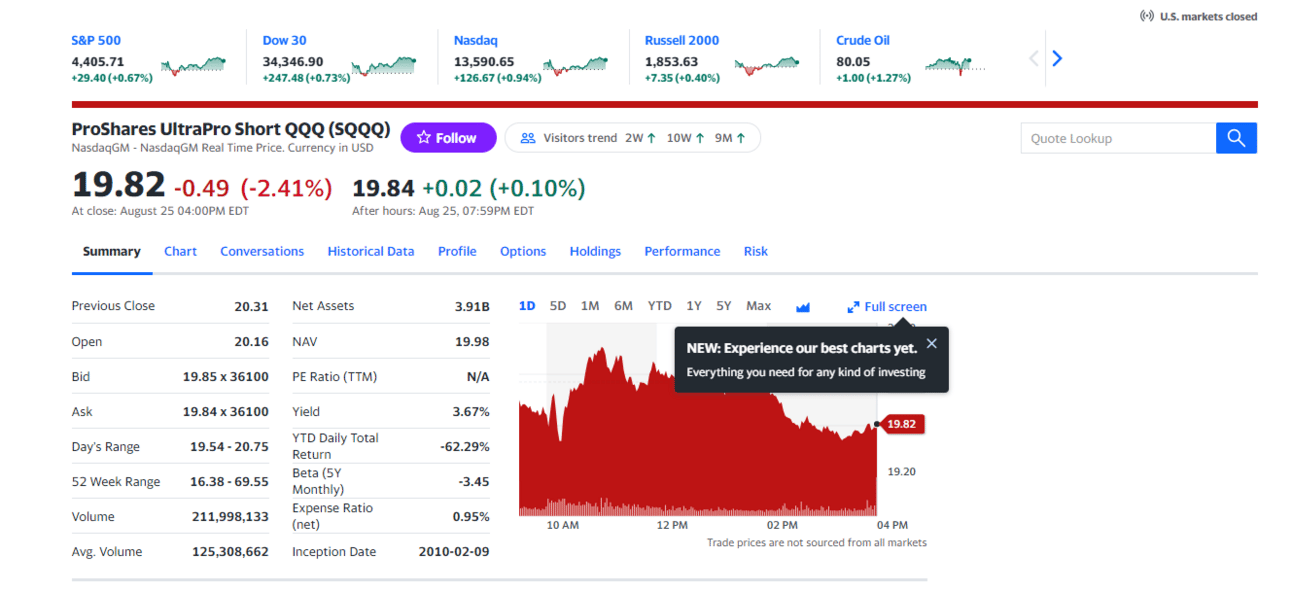

SQQQ

This ETF provides three times inverse exposure to the daily performance of the Nasdaq-100 Index, charging 95 basis points (bps) in annual fees. It has an AUM of $1.5 billion and trades in an average daily volume of about 69 million shares.

QID

This ETF provides two times inverse exposure to the Nasdaq-100 Index. It charges 0.95% in annual fees and trades in an average daily volume of 6.2 million shares.

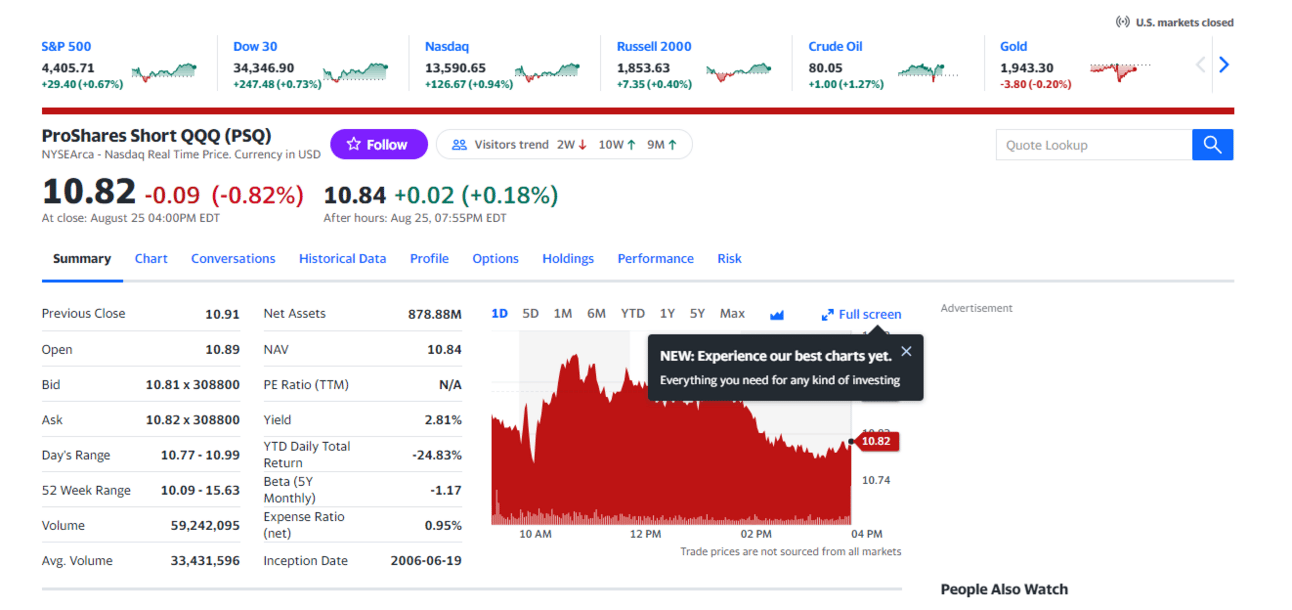

PSQ

This fund offers inverse exposure to the daily performance of the Nasdaq-100 Index. This means it trades at a 1 to 1 ratio against the Nasdaq. PSQ is the least riskiest of the shorting instruments. It has amassed $616.7 million in its asset base and trades in an average daily volume of 4.2 million shares.

Trade Idea

Each week I’ll include one possible trade set-up based on research done throughout the week. These trade ideas should not be construed as financial advice. Do your own research, as nobody can care more about your money than you!

$ACGO

Finding a trade idea that is not a tech stock is always a plus when scanning stocks. $ACGO is bouncing off the bottom of the rising support and has been channeling since January 2023.

This trade idea is a long trade idea with the upside being $128/$129 and then up to $139/$140.

Stop loss just below the rising support line at $115.54

Reward to risk = 2 to 1

Beta: 1.37

Remember to develop your trading plan and manage your risk on every trade. Stay green and we’ll see you for next week’s Traders Playbook Newsletter

Disciplined Traders Research

Looking for potential charts with market analysis, reward-to-risk scenarios, and trade invalidations, check out the DTA Stock Market Research subscription.

Help Us Grow

Our mission is to impact 1,000,000 new traders positively. If this playbook would help someone you know learn how to swing trade the stock market please forward it to them.

And if someone forwarded this edition to you, please don't leave without hitting that Subscribe button now.